34++ How Do I Convert My Llc To An S Corp Ideas in 2022

How do i convert my llc to an s corp. Some corporate taxpayers are required to file electronically. All you need to do is fill out a form and send it to the IRS. To make an LLC to S corp. Before you choose to convert your S corporation to an LLC the tax consequences must be considered very carefully. They can help them convert to a corporation. The first is to dissolve the LLC and transfer all assets back to the individual memberowner then form a new S corporation and contribute the assets from the individual to the new entity. Once the LLC is classified for federal tax purposes as a Corporation it can file Form 2553 to be taxed as an S Corporation. Converting a single member LLC to an S corp can be done in two ways. Tax Consequences of Converting from S Corporation to LLC. New Responsibilities With Incorporation. When an LLC wants to be an S corporation instead they will need to formally change their entity type with the. The process of changing the tax status of an LLC to a corporation or S corporation is called an election.

The two processes are different. To elect Corporation status the LLC must file IRS Form 8832 - Entity Classification Election. If you want your election to be effective for the entire tax year it should be filed. By March 15 of the year you want the election to take effect. How do i convert my llc to an s corp Election with the IRS you need to file form 2553 Election by a Small Business Corporation. If you are changing from an LLC to a corporation through your states conversion process you must file a statement of conversion or similar document filing fee and any other documents required in your state. File the S corporation return Form 1120-S by the due or extended due date. Draft a letter to the IRS requesting that your S corporation election made when you filed IRS Form 2553 - Election by. How to convert an LLC to S Corporation For federal tax purposes you can simply make an election for the LLC to be taxed as an S Corporation. The above options are the same for both C corporations and S corporations but youll also need to file Form 2553 with the Internal Revenue Service if you convert to an S corporation. LLCs can file Form 8832 to elect their business entity classification a Subchapter-S Corp in your case. The IRS will consider your S corporation liquidated even if your merger has been completed or youve filed your Certificate of Conversion. The filing of the initial Form 1120-S return will finalize the change of the entitys filing requirement on the Internal Revenue Services records.

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

How do i convert my llc to an s corp Converting your LLC to an S-Corp when filing your tax return for tax purposes can be a complicated process but it is possible.

How do i convert my llc to an s corp. So youve decided the best next step for your company involves converting to a corporation. To elect S Corporation status the LLC must file IRS Form 2553 - Election by a Small Business Corporation. The form must be signed by shareholders and an officer of the company.

This involves filing a new entity and the expenses involved at the state level. Sole proprietorship election for an LLC is reserved for companies with only one owner-member. Withdraw your election to be taxed as an S corporation with the IRS.

A single-member LLC typically is a disregarded entity for income tax purposes and the member files all business activity of the LLC on Schedule C of their own income tax return. In order for the entity to be changed from an LLC to a corporation the business will need to file with the state agency who is in charge of corporate filings. You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return.

How do i convert my llc to an s corp You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return.

How do i convert my llc to an s corp. In order for the entity to be changed from an LLC to a corporation the business will need to file with the state agency who is in charge of corporate filings. A single-member LLC typically is a disregarded entity for income tax purposes and the member files all business activity of the LLC on Schedule C of their own income tax return. Withdraw your election to be taxed as an S corporation with the IRS. Sole proprietorship election for an LLC is reserved for companies with only one owner-member. This involves filing a new entity and the expenses involved at the state level. The form must be signed by shareholders and an officer of the company. To elect S Corporation status the LLC must file IRS Form 2553 - Election by a Small Business Corporation. So youve decided the best next step for your company involves converting to a corporation.

How do i convert my llc to an s corp

Indeed lately is being hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will talk about about How Do I Convert My Llc To An S Corp.

How do i convert my llc to an s corp. A single-member LLC typically is a disregarded entity for income tax purposes and the member files all business activity of the LLC on Schedule C of their own income tax return. In order for the entity to be changed from an LLC to a corporation the business will need to file with the state agency who is in charge of corporate filings. You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return. A single-member LLC typically is a disregarded entity for income tax purposes and the member files all business activity of the LLC on Schedule C of their own income tax return. In order for the entity to be changed from an LLC to a corporation the business will need to file with the state agency who is in charge of corporate filings. You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return.

If you are looking for How Do I Convert My Llc To An S Corp you've arrived at the right location. We have 51 images about how do i convert my llc to an s corp including images, pictures, photos, wallpapers, and more. In such page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Business Formation Ms Business 101

Business Formation Ms Business 101

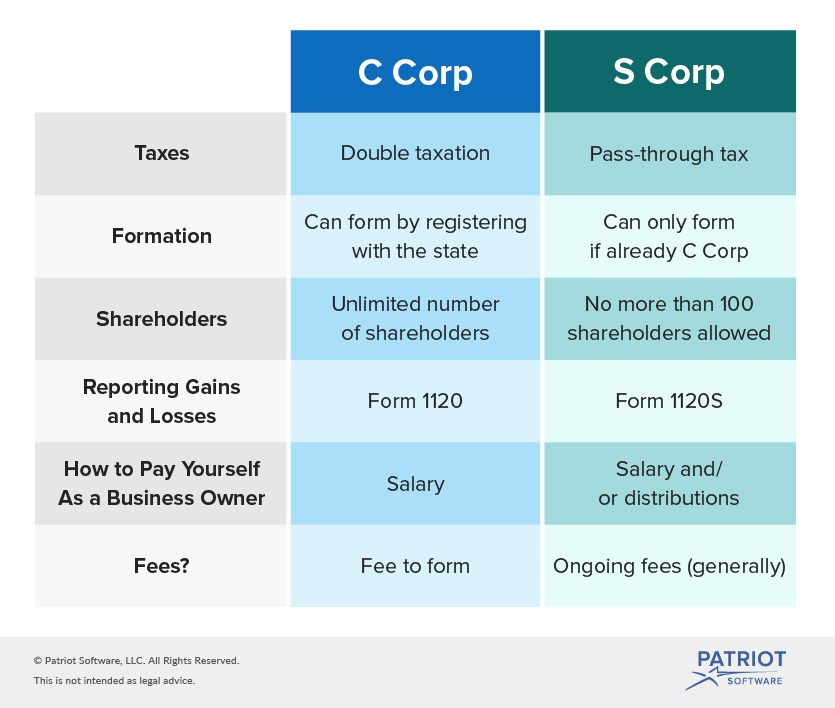

What Is The Difference Between S Corp And C Corp Business Overview

What Is The Difference Between S Corp And C Corp Business Overview