25+ How Do I Amend My 2012 Tax Return On Turbotax Ideas

How do i amend my 2012 tax return on turbotax. Through CRA My Account ReFile using your tax solution or by mail. Select 2019 then Amend change your return. But when I press amend tax return and look at the top left corner there is a much bigger amount and it says in progress. For all Tax Years prior to 2020 Prepare Print Sign and Mail-In - see addresses above - your Tax Amendment as soon as possible. Taxpayers who discover they made a mistake on their tax returns after filing can file an amended tax return to correct it. The instructions for Form 1040X Amended US. Amendments can be made for 10 previous years so if you are filing this years 2020 you can only amend back to 2010. For Tax Years 2012-2016 complete Form MI-1040X-12. Yes you can make changes to a filed tax return by filing an adjustment. Scroll down to Your returns and documents you may need to select Show. Individual Income Tax Return list more reasons to amend a return. You can access the Form 1040X on the IRS website.

She said there was no trouble with my 2013 tax return. If you prepared your original tax return using TurboTax log in to your account open the tax return you already filed and click on the link to amend your return. Each state has its own version which you can obtain through its tax departments website. This is normal for amended returns. How do i amend my 2012 tax return on turbotax Georgia Department of Revenue Processing Center PO. How to file an amended tax return To file an amended federal return youll need to fill out the three-column Form 1040X. Then you can Amend your Tax Return by filing Form 1040-X to include your. If you need to prepare and file a tax return from a previous year login to. Sign in to TurboTax. I found out that the payment was not debited from my bank account. The Canada Revenue Agency CRA requires that you wait until youve received your Notice of Assessment NOA before filing an adjustment. Youll need to send an amended return by mail. You need to complete sign Form 500X for the appropriate Tax Year you are amending - Print Mail the Form to.

Dealing With A Missing W 2 Or Using Form 4852 Instead Don T Mess With Taxes

How do i amend my 2012 tax return on turbotax I went to the local IRS office an met with a representative.

How do i amend my 2012 tax return on turbotax. Check the Form 1040X Instructions to find your states IRS Service Center address. On the forms taxpayers typically copy line items from their original return noting which should be corrected and the net change. If you need to file an amendment for Tax Years 2011 and prior use Form MI-1040X.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Or of course HR Block tax professionals can help you file an amended return. I e-filed my 2013 TurboTax return with their program Evidently the IRS did not get it.

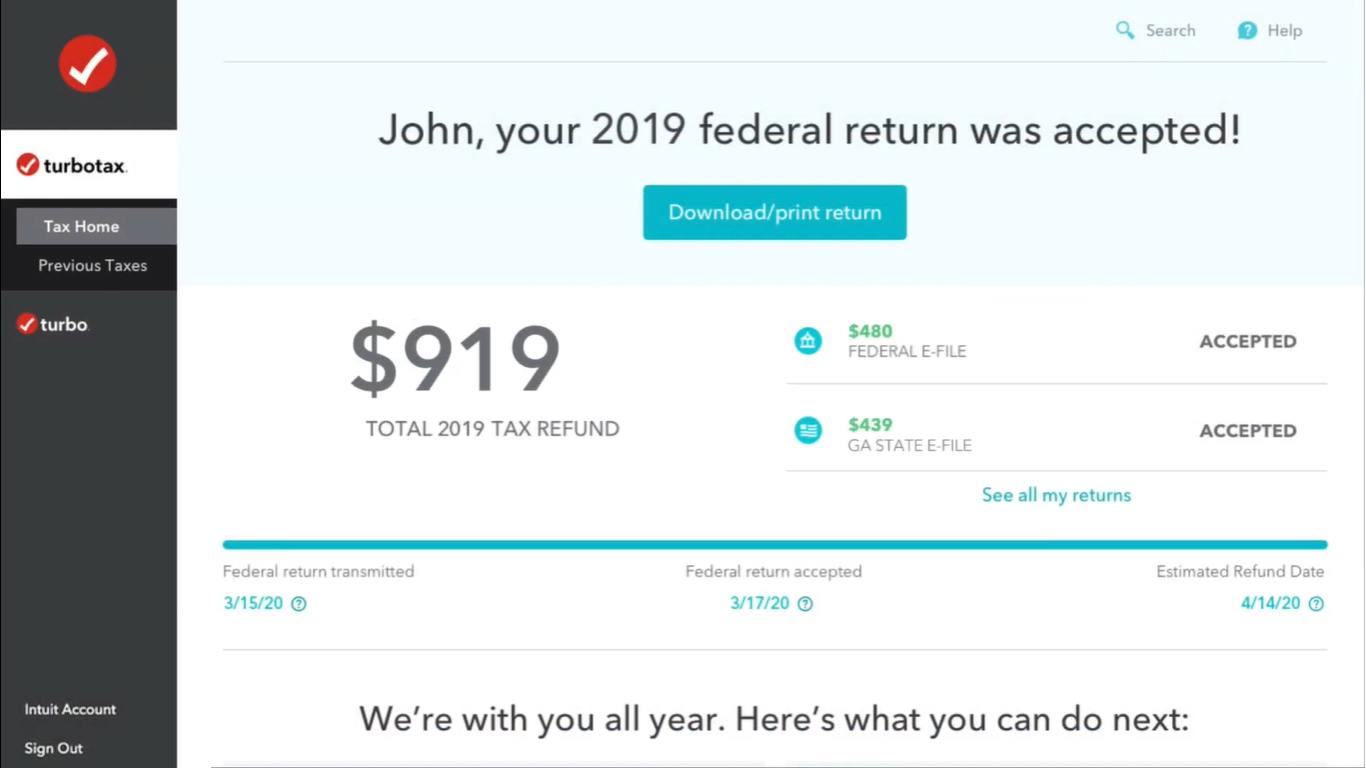

When I go to turbotax free edition website it says the original amount that I got on the front page with nothing even mentioning the10200. Box 740318 Atlanta Georgia 30374-0318. The software was installed on an old computer but I have the turbotax files.

How can I view my 2012 and 2010 turbotax returns. There are three ways to make amendments to your tax return. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021.

Yes you can Amend through TurboTax. For Tax Year 2017 select the 2017 Tax Year Form MI-1040 and attach Schedule AMD to your MI-1040. You will also file an IRS Tax Amendment.

Since you have already filed your returns and they have been Accepted you need to wait until the IRS fully processes your return and you receive your refund. From there the software will walk you through the process of filing the amendment. There are rules and limitations for each one.

Dont worry if your refund changes to 0. This includes changing the filing status and dependents or correcting income credits or deductions. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023.

When you get to the Lets get a kickstart on your 2019 amended return screen carefully follow the instructions. I am having the hardest time finding out when and how much my refund will be. Terms and conditions may vary and are subject to change without notice.

I found out when I was later planing to amend it. You cannot e-File a GA Tax Amendment anywhere except mail it in.

How do i amend my 2012 tax return on turbotax You cannot e-File a GA Tax Amendment anywhere except mail it in.

How do i amend my 2012 tax return on turbotax. I found out when I was later planing to amend it. Terms and conditions may vary and are subject to change without notice. I am having the hardest time finding out when and how much my refund will be. When you get to the Lets get a kickstart on your 2019 amended return screen carefully follow the instructions. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. This includes changing the filing status and dependents or correcting income credits or deductions. Dont worry if your refund changes to 0. There are rules and limitations for each one. From there the software will walk you through the process of filing the amendment. Since you have already filed your returns and they have been Accepted you need to wait until the IRS fully processes your return and you receive your refund. You will also file an IRS Tax Amendment.

For Tax Year 2017 select the 2017 Tax Year Form MI-1040 and attach Schedule AMD to your MI-1040. Yes you can Amend through TurboTax. How do i amend my 2012 tax return on turbotax For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. There are three ways to make amendments to your tax return. How can I view my 2012 and 2010 turbotax returns. The software was installed on an old computer but I have the turbotax files. Box 740318 Atlanta Georgia 30374-0318. When I go to turbotax free edition website it says the original amount that I got on the front page with nothing even mentioning the10200. I e-filed my 2013 TurboTax return with their program Evidently the IRS did not get it. Or of course HR Block tax professionals can help you file an amended return. You must wait to receive your Notice of Assessment before making any changes to your tax return.

Indeed lately is being sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will talk about about How Do I Amend My 2012 Tax Return On Turbotax.

If you need to file an amendment for Tax Years 2011 and prior use Form MI-1040X. On the forms taxpayers typically copy line items from their original return noting which should be corrected and the net change. Check the Form 1040X Instructions to find your states IRS Service Center address. How do i amend my 2012 tax return on turbotax .

How do i amend my 2012 tax return on turbotax

How do i amend my 2012 tax return on turbotax. I found out when I was later planing to amend it. You cannot e-File a GA Tax Amendment anywhere except mail it in. I found out when I was later planing to amend it. You cannot e-File a GA Tax Amendment anywhere except mail it in.

If you re searching for How Do I Amend My 2012 Tax Return On Turbotax you've arrived at the ideal location. We have 51 images about how do i amend my 2012 tax return on turbotax including images, pictures, photos, backgrounds, and more. In these page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.